Buying a stock — especially that first time you become a bona fide part owner of a business — deserves its own celebratory ritual.

But before we pick out shareholder party hats and rent a ticker tape confetti cannon, let’s review how to buy stocks online.

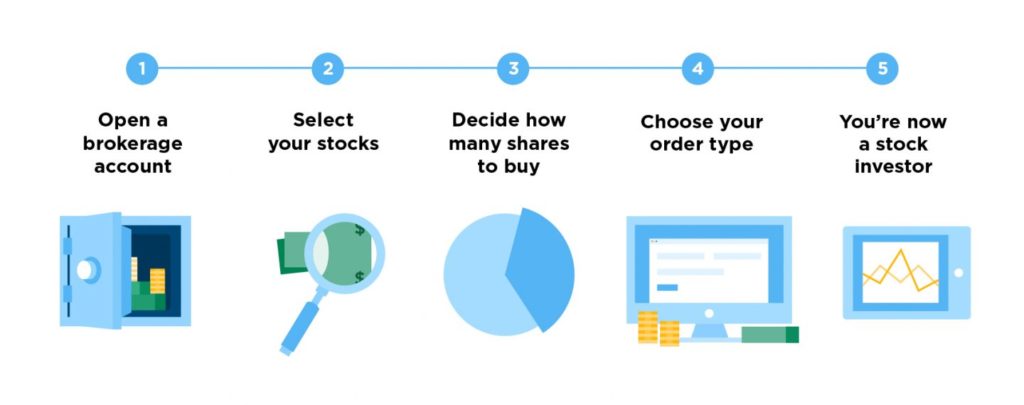

Buying stocks in 4 steps

- Open a brokerage account. Look for low fees and user-friendly features.

- Select your stocks. Seek companies with strong long-term growth prospects.

- Decide how many shares to buy. Base this on your budget and desired allocation.

- Choose your order type. Use “market” or “limit” in most cases.

Ready to start? Read on for more detail on each of these steps.

Step 1: Open a brokerage account

Wondering where to buy stocks? Movies love to show frenzied traders shouting orders on the floor of the New York Stock Exchange, but these days very few stock trades happen this way. Today, the easiest option is to purchase stocks online through a brokerage.

Opening a brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose how you want to fund the account. You may fund your account by mailing a check or transferring funds electronically.

How do you find a broker that’s worthy of your dough? It’s not just about finding the one with the cheapest trading commissions. Paying a few bucks more per trade at a brokerage that provides high-quality customer service is worth it, especially when you’re new to buying stocks.

Some other things to consider:

- How much money you have. Many online brokers have a $0 minimum requirement to set up a traditional individual retirement account or Roth IRA. For a regular brokerage account, the minimums can range from $0 to $2,000 or more.

- How frequently you plan to trade. At most brokers suitable for new investors, stock trading commissions run between $5 and $10. Low commission costs will be more important to active traders, those who place 10 or more trades per month. Infrequent traders should steer clear of brokers that charge inactivity fees.

- How much support you want. Consider the broker’s offerings of educational tools, investment guidance, stock-trading research and access to real, live humans via phone, email, online chat or branch offices.

Once you’ve set up and funded your brokerage account, it’s time to dive into the business of picking stocks. A good place to start is by researching companies you already know from your experiences as a consumer.

Don’t let the deluge of data and real-time market gyrations overwhelm you as you conduct your research. Keep the objective simple: You’re looking for companies of which you want to become a part owner.

Warren Buffett famously said, “Buy into a company because you want to own it, not because you want the stock to go up.” He’s done pretty well for himself by following that rule.

Start with the company’s annual report — specifically management’s annual letter to shareholders. The letter will give you a general narrative of what’s happening with the business and provide context for the numbers in the report.

After that, most of the information and analytical tools that you need to evaluate the business will be available on your broker’s website, such as SEC filings, conference call transcripts, quarterly earnings updates and recent news. Most brokers also provide tutorials on how to use their tools and even basic seminars on how to pick stocks.

Step 3: Decide how many shares to buy

You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio position in a stock all at once. Consider starting small — really small — by purchasing just a single share to get a feel for what it’s like to own individual stocks and whether you have the fortitude to ride through the rough patches with minimal sleep loss. You can add to your position over time as you master the shareholder swagger.

Step 4: Choose your order type

Don’t be put off by all those numbers and nonsensical word combinations on the order page. Refer to this cheat sheet:

Basic stock trading terms

| Ask | For buyers: The price that sellers are willing to accept for the stock. |

| Bid | For sellers: The price that buyers are willing to pay for the stock. |

| Spread | The difference between the highest bid price and the lowest ask price. |

| Market order | A request to buy or sell a stock ASAP at the best available price. |

| Limit order | A request to buy or sell a stock only at a specific price or better. |

| Stop (or stop-loss) order | Once a stock reaches a certain price, the “stop price” or “stop level,” a market order is executed and the entire order is filled at the prevailing price. |

| Stop-limit order | When the stop price is reached, the trade turns into a limit order and is filled up to the point where specified price limits can be met. |

There are a lot more fancy trading moves and complex order types. Don’t bother right now — or maybe ever. Investors have built successful careers relying solely on two order types: market orders and limit orders.

MARKET ORDERS

With a market order, you’re indicating that you’ll buy or sell the stock at the best available current market price. Because a market order puts no price parameters on the trade, your order will be executed immediately and fully filled, unless you’re trying to buy a million shares and attempt a takeover coup.

Don’t be surprised if the price you pay — or receive, if you’re selling — is not the exact price you were quoted just seconds before. Bid and ask prices fluctuate constantly throughout the day. That’s why a market order is best used when buying stocks that don’t experience wide price swings — large, steady blue-chip stocks as opposed to smaller, more volatile companies.

Good to know:

- A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed.

- If you place a market order trade “after hours,” when the markets have closed for the day, your order will be placed at the prevailing price when the exchanges next open for trading.

- Check your broker’s trade execution disclaimer. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week.

LIMIT ORDERS

A limit order gives you more control over the price at which your trade is executed. If XYZ stock is trading at $100 a share and you think a $95 per-share price is more in line with how you value the company, your limit order tells your broker to hold tight and execute your order only when the ask price drops to that level. On the selling side, a limit order tells your broker to part with the shares once the bid rises to the level you set.

Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. They’re also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment.

There are additional conditions you can place on a limit order to control how long the order will remain open. An “all or none” (AON) order will be executed only when all the shares you wish to trade are available at your price limit. A “good for day” (GFD) order will expire at the end of the trading day, even if the order has not been fully filled. A “good till canceled” (GTC) order remains in play until the customer pulls the plug or the order expires; that’s anywhere from 60 to 120 days or more.

Good to know:

- While a limit order guarantees the price you’ll get if the order is executed, there’s no guarantee that the order will be filled fully, partially or even at all. Limit orders are placed on a first-come, first-served basis, and only after market orders are filled, and only if the stock stays within your set parameters long enough for the broker to execute the trade.

- Limit orders can cost investors more in commissions than market orders. A limit order that can’t be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is made. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed.

Congratulations, you’re now a stock investor

We hope your first stock purchase marks the beginning of a lifelong journey of successful investing. But if things turn difficult, remember that every investor — even Warren Buffett — goes through rough patches. The key to coming out ahead in the long term is to keep your perspective and concentrate on the things that you can control. Market gyrations aren’t among them. What you can do is:

- Make sure you have the right tools for the job.

- Be mindful of investing fees. These can significantly erode your returns.

- Establish investing rules to help you keep cool when others panic.

- Still unsure about picking individual stocks? Consider the best brokers for mutual funds instead.